|

A new economics and integrated business model is possible.

Go to: Project NEMO (New/Next Economic Model)

Go to: INSEDE (Institute for Sustainable Economic Development)

Go to: Business Engineering Systems

(New perspectives for the design and development of economy, politics and community)

to original bengin ¦

to original bengin ¦  to English (beta)

to English (beta)

This is a transcript of a speach Walter Wriston held at the

"Measuring the Future" Conference

of the CBI (Center of Business Innovation) of Cap Gemini Ernst & Young in Boston.

Unfortunately CBI has been closed by Cap Gemini - may be they could not find the intangible assets of CBI (its real value) in Caps' balance.

Now you may find the director of CBI Chris Meyer at LinkedIn

Measuring the Future: Navigating the New Economy

Transcript

The Great Disconnect:

The Balance Sheet vs. Market Value

Walter Wriston, Boston, October 2, 2000

MR. MEYER: -- Walt

Wriston is going to talk about that new economy and those issues of how

we measure value in the intangible economy.

Let me tell you a little bit about Walt and little about that handshake

because it's symptomatic. Walt is probably known to you as a pioneer in the

evolution of banking in the last 30 years. A little history. Walter Wriston

went to Wesleyan. He then got a degree in Diplomacy from the Fletcher

School. And now, Walt says that no one who knows him believes he has a

degree in diplomacy. That might be borne out by the next stage of history

where he went to the State Department for a year. Diplomacy failed him so he

went to war in the Army for four years, continuing politics by other means,

I guess. Now, this was a somewhat less powerful platform, apparently, than

the Harvard Business School is today because after that experience because,

unlike what Clay Christensen reports to us happens to the HBS graduate, Walt

joined what was then First National CitiBank in 1946 as the junior inspector

in the controller's office, but he began a meteoric rise because four years

later, by 1950, he had become an assistant cashier.

Now, somehow things changed and to accelerate both his career and my

introduction, by 1967 he had become President and CEO of CitiCorp and added

Chairman to his title in 1970. And, it really was Walt Wriston who propelled

banking into the global arena. (Citibank was) the first to build a global

network, to move money around the world continuously, the first to have a

vision that he articulated in his book The Twilight of Sovereignty in

which the financial institutions not -- that is the private financial

institutions, not the governmental ones, governed the currency flows and

financial flows of the world.

But there's another reason that Walt is here, and Walt is the right person

to talk to about this. The CBI has an advisory board called The Visiting

Fellows and when we looked for people to join it, we were looking for people

of stature and imagination and open mindedness, and someone proposed Walt to

us. And we thought, "God, he would be perfect," but we worried

about one thing. We had all ready signed up Neil Stephenson, a cyberpunk

science fiction writer, who last year had a best seller called Cryptonomican.

And we had these visions, not knowing either of them, of the cyberpunk

author and the banker emeritus meeting one another and actually not having a

frequency in common on which to communicate.

In the event, exactly the opposite happened. Neil and Walt became great

friends. And, Walt told Neil a story about Shanghai during World War II that

became the opening to Neil's Cryptonomican novel. And I say that as

kind of a proof statement that when we listen to Walt talk about how the

future of measurement and economic value will evolve, we're listening to

someone who combines experience, wisdom, and open mindedness. So, please

welcome Walt Wriston.

[applause]

MR. WRISTON: Well, I want to thank

you for letting me be here. I have some problems sometimes with my grandson…

his idea of music. But if I can get a copy of that picture with Chuck D, I'm

golden from now on out. [laughter]

I think that we had this conference today on measurement and it was

prestaged I think by Galileo. He said, "We must measure what is

measurable and make measurable what cannot be measured." And I think he

hit it right on the nose many years ago. I would say that almost from the

very beginning of recorded history, man has attempted to take the measure of

things, the passage of time, the size of things, or the distance to some

location. Indeed, there are some historians who have suggested that the

eminence of measurement itself has to rank among the major achievements of

man.

Our reliance of measurement in our daily lives is so persuasive, so

pervasive, that we hardly notice or even reflect upon how much we rely on a

speedometer in our car or the time of our watch or the government figures on

the GDP.

Because, however, there's money to be had, many attempts have been made to

link one set of data or another to the market value of a given stock. There

are those who look at the corporate results as revealed by GAAP accounting

and compare those stated values with a market value. And they declare the

market is a huge bubble or even proclaim the market suffers from irrational

exuberance.

On the other hand, there are corporate CEO's whose reports record record

high earnings. They stand around and watch as their stock price declines,

and complain that the market is totally irrational and unreasonable. There

are others who look at return on invested capital and complain that their

so-called old economy company requires large amounts of capital for plant

and equipment thus reducing their return on capital, while a new

economy company has to invest substantially less and, therefore, its return

on capital soars.

There are numerous other theories, but they are all spawned by the fact that

it is clear that the market value does not appear to be based on a six-month

old annual report or even last week's 10Q. Something else is going on. The

talking heads on the evening news explain to us why the market went up or

down, add almost nothing to our knowledge of economics but a great deal to

the skill of creative writing.

Some years ago, a Nobel winner, James Tobin, created what came to be called

the Tobin Q, in which he indicated that the best yardstick of market value

was a replacement value of the books of the company. In short, replacement

of corporate assets should have an equilibrium relationship with the value

the market places on the stock.

In the height of the industrial age, there are a good many people who agreed

with Professor Tobin. Since his position was originally put forward, however,

the world has changed. And I believe that argument can be made that the

Tobin Q is no longer a relevant way to measure the reasonableness of a

company's market value in the new economy.

As Robert Solow once wrote, there's a lot to be said in favor of staring at

a piece of reality you are studying and asking just what is going on here?

What is going on here is unrecorded intellectual capital. And when that

becomes the driving force in the economy, it is clear that the book value

and some of the old rules may not have the same felicity as they had in the

past. It is not unlike, in my view, trying to measure the speed of a

computer by the old industrial measures of pounds per square inch or

revolutions per minute, both of which were extremely valid measures in the

machine age but have little relevance today.

When I was a young lending officer at CitiBank, my boss told me always to

check the freight car loadings in Chicago, which he said represented the

best proxy for how the economy was performing. It was a good index back then

but is not of a great deal of use today. Even though the world has changed,

there is a natural desire to hang on to yesterday and to embrace the

familiar.

Although numbers look and are definitive, few people bother to look behind

them to see how they are constructed. We have a mixed bag in this country

when it comes to measurements of all kinds. In the fiscal world, the United

States is an English island in a sea of metric measurements. Our corporate

accounting is different from that that is practiced in other developed

countries. Sometimes we even use two different systems in the same sentence,

or to be specific, on a can of soda. We measure our soft drink in ounces but

the fat in them is recorded in grams.

Sometimes the quality produces some serious consequences. The confusion

between the kind of metrics used in controlling the thruster of a space

vehicle caused the loss of $125 million spacecraft in September last year as

it was approaching Mars. The NASA controllers believed that the thrusters,

to alter the direction of the spacecraft, were calibrated in metric Newtons

while the builder had specified specifically that they were calibrated in

pounds. The difference was undetected for months, and when the final

adjustment was made in the flight as it approached Mars, it veered off

course by 60 miles. Nobody knows its fate, but it has either crashed or is

orbiting the sun.

The director of the propulsion lab, which was in charge of the mission said,

"The real issue is not that the data was wrong. The real issue is that

our process did not realize there was this discrepancy and correct for

it." I would argue that statement ranks right up there with world-class

spin control.

I think the same can be said for a lot of accounting data. It may be correct

as far as it goes, but it may miss the target of useful information by a

very wide margin. Indeed, I do not know a CEO in this country who would

attempt to guide his or her company's destiny based solely on the accounting

numbers produced by GAAP, even though the dictionary definition of corporate

accounting is to recognize the factors that determine its true condition.

In the scientific world, there has been a coming together of nations to

produce some standards, but this has been a very long and a very divisive

process. The modern metric system owes much to the committee on weights and

measures of the French Academy of Science in the early 19th

Century, which was headed by an astronomer, John Bordeaux (phonetic).

Their basic decision was to use a base of 10, and that unit would be used to

derive volume and area. The length of the unit, later called the meter, was

measured by the fraction of a meridian. This pioneering work furnished a

framework on which has built much of modern physical measurement. More than

100 years later, the general conference on weights and measures met again in

Paris in October 1960 and gave the name to the International System of Units

"the Metric System," based on the meter as a unit of length, the

kilogram a unit of mass, the second a unit of time, and the ampere a unit of

electrical current.

The system has continued to evolve as more and more nations have joined the

treaty, but there is no such treaty or an agreement on how to measure the

economy or corporate performance, even though we are inundated with data

that purport to tell us how we're doing, and unfortunately, sometimes

furnishes the basis for government action in the economic arena.

The numbers we do see are not always a very good guide. Nicholas Everstock

has commented, "Where unstrikeable, traditional beliefs or passing

superstitions played official roles in the past, we now witness an

overconfidence based on false precision. Where antique despots surrounded to

the temptation of numerology," he said, "the modern statesman

probably succumbs to the allure of quantifrenia and idolatry of numbers no

less reasoning and no less purely suited for promoting the common wheel than

his predecessors.

With the advent of the industrial revolution, it was clearly necessary for

man to devise some kind of record keeping that was more sophisticated than

that which was required for a one or two person farm. Merchants in those

days had no knowledge of books of account, and they often recorded

transactions by sticking a piece of paper on the wall. The great historian,

Fernand Braudel, tells us that the first known evidence of an accounts

ledger dates from 1211 in Florence, but it was not until 1517 that

double-entry bookkeeping was in general use.

As economies grew and prospered, first dozens and then hundreds and then

thousands of people were employed in a single enterprise and an accounting

system had to be devised, not only to keep track of what had happened but

also to permit managers to make informed business decisions.

Centuries later, there is still no accounting system that has total global

acceptability, either for business or for government. In the United States

there is, you all know, thousands of accounting rules and they are

constantly changing.

On the other hand, in the physical world, when one says that something is 10

meters long, all the world knows that they have received a universally

accepted measurement. During the great inflation not so long ago in the

American economy, when the price level rose 12 percent, major companies were

forced to publish up to five earnings per share numbers. So that in the end,

the investor had a plethora of data and little or no information about the

business. As inflation abated and the number of earnings per share

calculations shrank until we have now arrived at the current situation.

But matters affecting accounting have never moved very fast. To give you an

example, about the time that Columbus set sail, there was a monk named

Pacioli, who published a book on double entry bookkeeping, that's often

accredited with publicizing this practice. Even earlier, Benedetto Cotrugli

had published a similar work in 1458 and a second edition was published 100

years later. The fact that the second edition was identical to the first one

established a precedent for the speed in accounting changes [laughter] that

I would argue is still the norm today.

There were several big firms, by that standard at least, that still used

single entry bookkeeping well into the 19th Century. The Dutch

East India Company was one and the Sun Fire Office in London was another.

In today's networked information economy, the importance of knowledge

workers, as we all know, is rising rapidly, but the measurement for their

output has not kept pace. Measuring productivity of knowledge workers is

primitive at best and down right misleading at worst. Huge sections of our

economy are totally left out. So far, we can make some rough judgments about,

say, the productivity of a loan officer or an insurance underwriter, but we

have no real metrics at all in the service sector.

"Work on the productivity of knowledge workers," Peter Drucker has

recently written, "has barely begun. In terms of actual work on

knowledge work or productivity, he said, "we are in the year 2000,

roughly where we were in the year 1900, a century ago, in terms of the

productivity of the manual work." The government figures, such as they

are, cover less than 50 percent of the service workers of America. So when

you read in the paper that productivity goes up or down, (it) doesn't mean

very much. Since most Americans work in the service sector and their

productivity is either unmeasured or, as bankers were until late 1999, by

assuming their productivity was zero and output rose only as a function of

the number of hours worked.

This method of computing output solely on the basis of input affects between

25 and 30 percent of the entire service sector of the United States. Now,

the people who produce these numbers, about zero productivity and banks,

walked by and often used ATM's for their banking needs, but they fail to

make any connection between that and productivity.

I would argue that since knowledge workers constitute more than half our

workforce, improving their productivity is a linchpin upon which hangs the

future prosperity of our country. At the end of the day, this means that we

have to find metrics that measure quality, as well as quantity.

For example, is a loan officer who makes a lot of loans and has few defaults

more or less productive than a lender who makes a few loans and has no

defaults? We have no agreed upon measures. Indeed, there is a clear

disconnect between what is measured and what is important. The world has

simply moved faster than those who measure it.

On another front, everyone from Main Street to Wall Street watches the

inflation numbers. The numbers going up, we assume that the Federal Reserve

will take action. With so much riding on the veracity of the numbers, it's

vital that a full review of those numbers was conducted.

Accordingly, Congress created an advisory panel on consumer price, chaired

by Mike Boskin. And after his study, he reported that the CPA overstated the

change in the cost of living by 1.1 percent. That number seems small, almost

irrelevant but compounded over time, the effects were incredible. For

example, instead of falling by 13 percent, real hourly wages had really

risen by 13 percent from 1973 to '95.

Now that's a mind bending change that affects millions of us across the

country, with about 1/3 of the federal budget outlays index to the cost of

living as our income tax brackets, the distortion between the numbers

reported, and the real world is huge.

Another example of how the public data conceals reality, in my view at

least, is the savings rate in this country or the lack thereof.

Many analysts look at the savings rate as a way of predicting how the

economy of the country will unfold. For example, a low savings rate may

foretell a scarcity of capital that could cramp the growth of the economy,

while a large rate portends ample money for all. Many commentators have

deplored that Americans don't have enough money and that our savings rate is

said to be so low as compared to other nations. Sometimes the savings rate

is in the paper. Yesterday, it said that it was negative.

Now while the official numbers seem to confirm this story, it is the way

these numbers are put together that assures the result. Until last year,

just for example, government employees' pensions were counted as government

savings instead of being private, as they are in private pension plans. The

press often reports this lack of savings in America by running in

juxtaposition a story that the inflow of money to mutual funds has just hit

an all-time high, that the purchase of new homes, many people's principle

asset, continues the pace, that IRA's and 401K's are bulging with cash and

most corporate pension plans are overfunded.

All of these events, plus the purchase of consumer durables, represents

savings by Americans and they constitute a direct disconnect from the

official savings number, which is derived by computing savings as a

proportion of disposal income individuals set aside. I would argue that

measurement in the private sector is little, if any, better.

The companies in the industrial age that spawned our current accounting

rules had huge sums invested in hard assets, things you could feel and touch

and count, like buildings and factories and inventory. In the new economy,

intellectual capital is far more important than money capital. But so far,

it goes mostly uncounted in the balance sheets of our corporations because

it is largely ignored by the writers of accounting standards.

Examples abound, but to cite just one example the value of patents is

nowhere to be seen on a corporate balance sheet. This is not exactly a

trivial matter. The best estimates of the value of patents range from $115

billion to a little over a $ trillion. And the number of patents filed each

year is exploding. Ten years ago, for example, Microsoft had one patent,

while today it has somewhere around 800, while the other companies in the

valley, like Intel, Bell, Novel, Sun, Oracle have increased their patent

filings by more than 500 percent.

While the American accounting profession has now produced about 5,000 pages

of accounting rules, Bob Elliott, a partner of KPMG has pointed out,

"At best," he said, "today's financial statements are an

obsolete product," relatively unchanged over the last 100 years.

Financial statements were designed to describe industrial era assets,

inventory, machinery, buildings, and land. Post-industrial enterprises run

on intangible assets, such as information, research, development, brand

equity, capacity for innovation, and human resources. Yet, none of these

appear on a balance sheet.

Today there's a debate going on about how to handle good will among various

accounting authorities around the world. One school holds that it should be

written off against earnings, which is another way of saying that

intellectual capital or the worth of a brand name, like CitiBank or

Coca-Cola, has no value.

On the other side of the argument is the marketplace, and its verdict is

loud and clear. Microsoft, for example, which has basically trivial fixed

assets, has a market cap exceeding the big three automobile companies put

together. This being so, it becomes increasingly hard to argue that

intellectual capital has no value. The old guard will say that this view is

just a way of measuring hot air and not real assets. Even though many of the

so-called "real assets" are rusted hulks in the scrap yard of

history, while the firms based on intellectual capital, like AOL, are

propelling themselves into the new economy.

As bad data produces bad results, both the public and the private sector are

in need of new metrics for a new economy. So far, there has been little

progress in this direction, as there's a huge vested interest in the

familiar and the known. But reality is beginning to sink in and there are

scattered efforts to come to grips with a need for the new metrics.

There is no doubt that an essential factor and the success of the industrial

revolution was a use of accounting to permit management of huge enterprises.

But the old rules measure yesterday and usually only a point in time. Like

the numbers of the freight car loadings in Chicago, their usefulness has

come and gone.

Today’s investors and credit granters want, need, and can get an almost

constant stream of useful information. Audited financial statements have

their place in this stream of data, but the current accounting rules now

prevent, for example, a company in publishing a cash flow per share number,

data which many managers believe is vital to running a business.

To quote Bob Elliott again, "Financial statements are assembly line

Model T's," he said, "when what are needed as instruments designed

to client specific management criteria and performance," indicators,

such as the measure of customer satisfaction, product and process quality,

innovation, and new technology. But the pace of change is now so swift that

no bureaucracy, either public or private, can keep up. But as this huge

disconnect between markets and accounting becomes obvious, efforts both in

the public and the private sector are beginning attack this problem of

metrics.

The government has made a few modest changes in establishing the retail

index to take partially into account and measure the explosion of e-commerce.

The new index, which was initiated in March of this year, measures products

sold on the net, but it omits such things as services on on-line banking,

travel bookings, where a great deal of the action is. But the complexity of

attempting to measure the new economy is enormous. The players change, the

rules change, and the output changes. Despite all the mergers that have

taken place, there are far more players in the game than ever before.

In Mike Boskin's words, "Back when we had a very few products being

made by a small number of manufacturers, we needed a lot less detailed

information, and it was easier to come by."

In the private sector, there are many initiatives designed to create the new

metrics to measure the economy. Our hosts today are leading the parade on

that with the joint effort of Forbes, Ernst & Young's Center for

Business Innovation, and Wharton Research to create a kind of a value index.

With intangible assets apparently playing such a huge role in the stock

valuation, research is needed and is being undertaken to try to determine

the factors that are driving stock values.

Although this project is probably in its infancy, many of the tenets of

conventional wisdom are already falling by the wayside. One of the leaders

of the project reported that perhaps the most amazing result of our research

is that two intangible asset categories, the use of technology and customer

satisfaction, have not statistical association with market value.

There's another group down the road consisting of the Sloan School of

Management at MIT and the consultants of Arthur Anderson are also working to

find a way to value intangible assets. The scope and pervasiveness of the

problem is now becoming evident to all.

As the co-chair of that effort put it, "Even the Coca-Cola’s and

Disney's of this world are actually creating most of their value from assets

that do not appear on their balance sheet."

Another initiative is undertaken by the Brookings Institute about which you

will hear more at this conference. There's still another initiative in

creating measurements by Professor Baruch Lev at the New York University. In

his scenario, he has devised a way to measure the earnings impact, resulting

from knowledge-based activities. Using his metrics, Professor Lev has

constructed a chart, showing knowledge capital of dozens of firms derived by

computing the discounted value of future knowledge earnings. Now as this

methodology gets refined, more and more companies, I believe will recognize

that measuring knowledge capital will become even more important than

measuring their fiscal capital. This applies in every occupation to the

farmers growing produce, people driving trucks are making durable goods will

be supported and enveloped by network information resolution so that the

urgency of finding these new metrics is manifest to all.

Many accountants are far from comfortable with these new concepts. They like

things they can touch and feel, things that have a clear cost and that can

be verified. One can count physical inventory. One can dig back through the

records to find what an asset costs. But the concept of value creates huge

questions because value is an intangible concept, and yet, every sector of

our society is impacted.

Banks, for example, which like to have collateral for their loans, are

increasingly faced with the dilemma of what constitutes collateral. Some

major banks, such as BT Commercial, which is now part of the Deutsche Bank,

have lent hundreds of millions of dollars and taken as collateral the firms'

trade names and patents. The law has now progressed to the point where the

banks are able to obtain a perfected security interest in these intangible

assets.

This new kind of lending spawns a new kind of an appraiser, the value

appraiser, who gives the banks an appraisal of the value of intangible

assets so that the loan officer can make an informed judgment.

BT Commercial is not alone, as some of these loans are syndicated with many

other banks. All of this moves such valuation, ideas from the conference

room of think tanks into the real world of corporate finance.

Efforts to come to grips with the value of intellectual capital are not

confined to the United States. The Swedish consulting firm of Celemi has

developed what they call an "intangible asset monitor." Their

approach is somewhat different, but it aims at the same results. They have

to try to put a value on intangible assets.

One big Swedish insurance company, Skandia, is now using both internally and

with the public a set of metrics the call "the business navigator."

The company now publishes a report on its intellectual capital as a sort of

a supplement.

It took centuries for a universal system of measurement to evolve in the

fiscal world. Measurement moved from using various parts of the human body,

from the foot to the fingers, until the metric standard was finally adopted.

From the late 18th century, until the middle of the last, France

was the custodian of a specially constructed bar of metal kept at 0

centigrade bearing two finely engraved scratches, exactly 1 meter long. By

1960, however, the meter was defined by the wavelength of radiation produced

by the atoms of krypton 86.

No such precision will ever be possible in the economic world as the

conditions change over time. Despite that difficulty, it is becoming

increasingly evident that nations need a whole new chart of accounts and

that business needs new measures to measure the new economy. Since it took

centuries to get a generally accepted system of measurement in the physical

world, and even then one that's largely ignored by the people of the United

States, it seems clear that there is little hope of conforming our official

accounting system to the realities of the information network economic

before the next stage of the economy occurs.

What to do? There is clearly a massive disconnect between corporate

accounting the value the market puts on its stock. Even if you do not

believe in the efficient market theory, it's clear that the market is

creating real-time values at odds with conventional measures used by

analysts. In this situation, Carver Meads' famous admonition, "Listen

to the technology," could be paraphrased to say, "Listen to the

market." The market is saying that our current GAAP accounting, while

useful, is far from reflecting real reality in the network economy. While

regulators and CPA's continue to debate new rules, it's clear from past

history that if corporate managements want to get their story out about how

value is being created, some kind of a supplement detailing the companies'

intellectual capital is needed.

Unlike the Scandinavian example, which is basically concerned with the

environment, such a supplement in my view would have a different emphasis.

Since intellectual capital is the driver of the new economy, this

information has to be given equal prominence with the GAAP financials so

that analysts and the public will get more of the data they need to make a

value judgment. Such a tabulation, obviously, would be different for every

country, but I suggest that, say, a model of some company might read

something like this:

- Last year, we filed 78 patents. We had 15 prior filings granted and we

were able to license out 8 patents to others, which created a stream of

income of $130,000.

- Since constant learning is the only road to survival in this economy, we

conducted 10,000 hours of training for our staff. Some 37 percent of all

employees got some form of new training last year.

- To keep new ideas flowing, we hired 350 people last year. Some 62 percent

of the new hires had a masters degree or equivalent and 50 percent had prior

business experience.

- Some 40 percent of our products and services have been introduced during

the last five years so that the output of our R&D continues to be good.

- So far, 60 percent of our departments have gone through the six sigma

process, and we will complete the rest at next year.

- Our personnel turnover fell to a new low.

Now, these are obviously just a sample of what such a page might look like,

and they clearly can be expanded or changed, tailored to specific companies.

Whatever the content of that list, one thing is clear. It's intellectual

capital that drives the new economy.

It follows from this, that successful corporate managers must know that a

company’s real competition in the marketplace are not the ones that they

have been familiar with for years, but that the vital competition is now for

men and women with the brains to survive and prosper in the economy. If all

the brains go to one segment of the economy or to one company in your

industry but not to yours, then it doesn't really matter what your

competitors may be. You have all ready lost the race. This being so, I

believe that corporate reports should reflect this reality.

Thank you.

[applause]

Q&A

AUDIENCE:

(indiscernible) the complexities of the modern economy and is one of the

sponsors, original sponsors of the Santa Fe Institute. I wondered if you

could comment specifically about the measures of intangibles and

intellectual capital as it relates to uncertainty and complexity being

feature oriented metrics.

MR. WRISTON: Well, we did fund a

fellowship at the Santa Fe Institute, where Dwayne Farmer and the others

were studying on the complexity theory. It was designed, first of all, to

try to figure out the staffing of a telephone bank for credit cards. In

other words, how many people are going to call between 5 and 6 at night? How

many people will call between midnight and 2 o'clock? I don't know what the

result of it is. All I know is they answer the phone very promptly out there.

So something happened.

But other than that, I'm not familiar with what else they got out of it.

They did get that out of it, which with four big service centers and

100-million credit cards, it was very helpful. As far as measurement goes, I

don't know.

I'll try to put it on the Internet with Chuck D. Then what?

AUDIENCE: (indiscernible)

MR. WRISTON: Well as somebody said

here that the idea of patents and copyrights is in the Constitution of the

United States and so it's not something that's transitory. The first group

of Patents Commissioners consisted of the Secretary of State, the Secretary

of the Treasury, and the Attorney General of the United States. There are

people such as Thomas Jefferson who was on it. So patents became embedded in

the fabric of America.

And up to the time of Lincoln, for example, he owned a patent. You had to

put in a model, which couldn't be more than 12 inches square, and we had a

warehouse full of these models in Washington, DC. And fortunately or

unfortunately there was a fire and the models were destroyed and that

provision in the law was changed, so you don't have a model, which is

fortune because then it was merged with the copyright office, and we now are

copyrighting songs and books and articles and so forth.

My own instinct is that networks distribute power along the periphery and

that being so, it becomes increasingly difficult to control it from the

center. And if it were just a problem of the law or whatever… the law is

now clear, as far as copyrights and patents are concerned … the problem is

whether it can be enforced. And the way our political system works is

usually that the political system accommodates to the reality of the world.

So I would suspect that, obviously not knowing, over the next ten years,

we're going to have a different set of laws on this. You're not going to

take it out of the Constitution. The Constitution doesn't say how it should

be operated. It just says that there shall be this group to protect. They

didn't call it intellectual capital then. I can't remember the exact parse.

So, I would suspect we're going to have a change simply because you can't

enforce the thing with a network that's growing so fast over the world. I

have no idea how it will work out.

AUDIENCE:

I'm trying to tie in today's entire presentation. And I'm wondering if you

feel as if the reporting on intangibles and providing companies with a clear

understanding of their true value, whether or not you see that as a

disruptive technology or disruptive phase in corporate value analysis.

MR. WRISTON: I don't think that

based on prior history, that the youngest person in this room will live long

enough to see intellectual capital in the balance sheets. That's why I'm

suggesting that if we can agree that this is a driving force, we have to

find another mechanism. You're going to get it by Mr. Lizarraga or Mr.

Levitt or whoever is calling the shots, it won't happen. So I would like to

have this -- what I suggested some kind of a supplemental report, but I

would like to have it wrapped in so that it's in equal prominence, opposite

the balance sheet.

Now maybe -- I hope I'm wrong. I hope the accounting profession will figure

out a way to do it, but I'm not sure that it's going to happen very soon.

That being the case, what's the alternative? The alternative is to make some

kind of a supplemental thing. Mine was just a list, you know, of things that

interest me in a company. You can make your own. Maybe you should have 12 or

10. Maybe they should be in paragraphs. I don't know. But the idea of the

thing, I think has some merit to it. Does that answer you?

Yes, sir?

AUDIENCE:

Wouldn't you say though that the leadership of CEO's and others are equally

at fault for not pushing this? They talk about the value of the intellectual

capital, but when it comes to mergers and acquisitions it then is let's ring

out the costs and let's rationalize lines of business, etc. So, I mean, it's

a two-way street. You've been criticizing the accounting profession, which I

think is -- should get criticized. And what about the boardroom and the

leadership?

MR. WRISTON: I'm sorry. I couldn't

hear the last part. What is the question?

AUDIENCE: What about the culpability of

the leadership of companies not pushing changes in valuation and pushing the

importance of intellectual capital within their own organization?

MR. WRISTON: I don't think there's

any culpability either on the accounting profession or on the part of

corporations. People always say they like change and then you ask them to

move their house across the street, and you've got a real problem. A lot of

corporations that are running strictly on intellectual capital are making

some efforts on this. Some of the older companies aren't; I agree with you.

But I think that the efforts that are undertaken here now with the Cap

Gemini's Group and Brookings and even the FASB has got a task force under

Ralph Saul who is looking at this thing. So, I think that we're building

momentum on it, and whether or not the corporate America gets aboard, I

couldn't tell you. But they have been in the past very slow to embrace a

change of this nature.

AUDIENCE:

On the subject of following up on the question before about what

corporations should disclose and your suggestion about doing a supplement,

do you think it would be more valuable for a company to do a supplement on

their own for the public and the investment community, or do you think it

would be more valid if they referred to independent public sources of that

same kind of information?

MR. WRISTON: I think the

accountants can move into that field, if that's what you're suggesting. And

I don't know whether you'd have a certificate of audit on the supplement,

but it might be a new business department I can see Chris would like. But

yes, I think they could help. I don't know why the auditors' certificate

should and couldn't cover that in the new world and it would add some

verisimilitude to it as opposed to a puffery that some CEO might hand out.

Is that what's your point? Got a whole new business department working for

you, Chris.

AUDIENCE: (indiscernible).

MR. WRISTON: Thank you.

[applause]

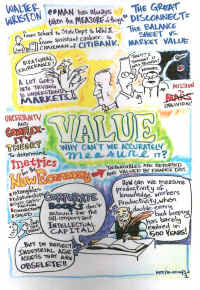

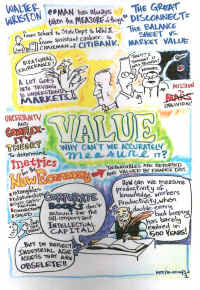

Cartoon of Walter Wristons' speach (click on image for

enlargement - 1'000KB)

"A new Information Revolution is

under way. [...]

It is not a revolution in technology, machinery, techniques, software or

speed.

It is a revolution in CONCEPTS.".

Peter F. Drucker

Management Challenges for the 21st Century, p.97

|